The longer the period chosen, the smoother the line.Īlways calibrate moving averages to your investing time horizon, which you can measure in hours, days or years. For both indicators, the shorter the time period you use, the faster the change in direction. The actual EMA calculation begins with the May 2 closing price. The EMA value for May 1 is seeded with that day’s closing price of 22.81. The EMA line tends to track the current price more closely. It’s the method used in calculating the EMA amounts, which shows a nine-day EMA calculation for Intel throughout May 2008.

#Sma ema stock calculation software

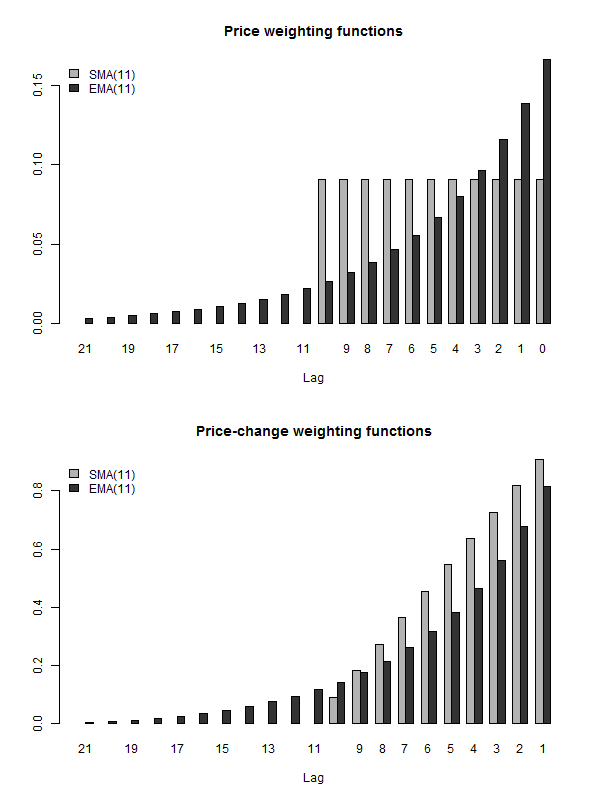

(Most investor charting software will display these averages with a click on a pull-down menu, with the user providing the desired time periods). The exponential moving average uses the same basic calculation of the SMA, but it gives greater weight to the more recent closings. Evaluating SMAs and EMAsĪs long as you're delving into SMA and other financial acronyms, consider the related EMA indicator. You should always take into account factors that have nothing to do with the fundamental financial well-being of the company, such as market trends, speculative selling, or macroeconomic news that might be coming into play.

However, trading on that signal alone is hazardous. When a rising short-term SMA dips across the long-term and heads downward, the stock migh be reversing its upward trend. To experienced investors, the SMA crossover provides a flashing mathematical beacon that shows a (possible) change in price trend. Plotting a long-term SMA (100 days, for example) alongside a short-term line (20 days) gives you parallel indicators that from time to time will cross over each other. For this, two different SMAs can be plotted on the same chart. The most important consideration for investors is not what happened in the past - they want to know the future. SMAs smooth out the price action and give you a little clarity. When the SMA is falling, then the stock has been pulling back. Although it might have dips and swoons from day to day, investors in general are showing optimism. When the SMA is rising, then the stock price is going up, generally.

Implications of Rising, Falling and Steady Charts The result is a number that might be above or below the current price of the stock, and which trends in the general direction of that price. To get a 20-day simple moving average, for example, you add up all the price closings over the last 20 days and then divide by 20. When analyzing stock charts, a little history comes in handy: specifically, the recent trend in price, which the simple moving average will reveal The SMA is the sum total of the stock price over a specified period of time, divided by the number of days in that stretch. SMA is calculated by adding closing stock prices over a period of time and dividing the sum by the number of days during the same time period.

0 kommentar(er)

0 kommentar(er)